Indicators on Bankruptcy as an Option: Can it Help Stop Wage Garnishment in Maryland? You Should Know

Top Methods to Stop Wage Garnishment in Maryland

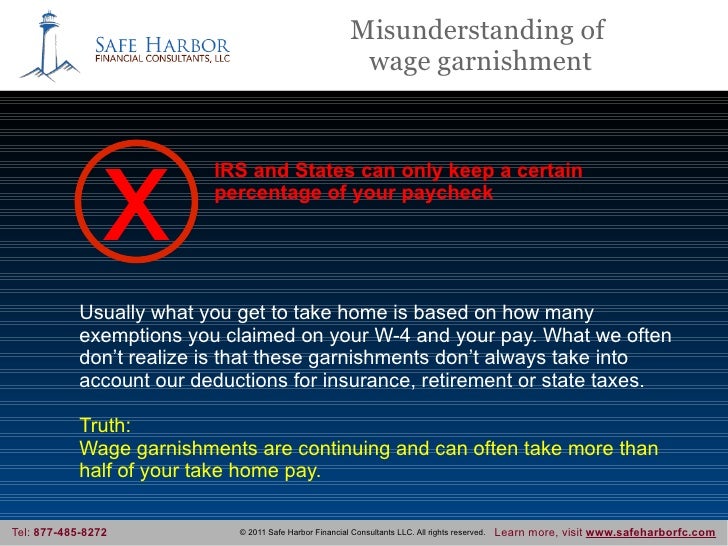

Wage garnishment may be a distressing scenario for people who are currently straining with economic troubles. It takes place when a court of law buy an company to withhold a portion of an employee's wages to delight a financial obligation been obligated to pay to a lender. If you're dealing with wage garnishment in Maryland, it's essential to know your rights and check out strategies to stop or minimize the garnishment. In this write-up, we will cover some reliable strategies that can aid you browse this challenging situation.

1. Recognize Maryland's Wage Garnishment Laws:

The first action in stopping wage garnishment is understanding the particular laws and requirements in Maryland. The condition has actually its personal collection of rules concerning wage garnishment, which restrict the amount that collectors can take coming from your wages. Under Maryland rule, financial institutions can easily normally simply withhold up to 25% of your non reusable earnings or the quantity going beyond 30 opportunities the government minimum required wage.

2. Look for Find More Details On This Page :

If you're facing wage garnishment, it's necessary to find legal guidance coming from an experienced lawyer concentrating in debt and consumer protection rules. They can guide you by means of the procedure, aid examine your situation, and explore potential lawful defenses or exceptions on call under Maryland rule.

3. Bargain with Creditors:

In some instances, haggling with your collectors may be achievable before wage garnishment happens or even after it has began. Speaking to your lender straight and describing your economic difficulty could lead them to agree on an substitute monthly payment strategy or also take into consideration dropping the wage garnishment completely.

4. Documents for Insolvency:

While filing for bankruptcy ought to be looked at as a last retreat, it can deliver instant relief from wage garnishments under particular situations. When you submit for insolvency in Maryland, an automated stay goes right into impact that quit the majority of compilation activities versus you, featuring wage garnishments.

5. Contest the Judgment:

If you believe that there are actually authentic grounds to dispute the judgment leading to the wage garnishment, you may submit a activity with the court to have it reviewed. Authentic premises might consist of improper company, shortage of suitable notification, or inaccuracies in the judgment itself. Speaking to with an attorney is vital to figure out if contesting the judgment is a practical possibility in your certain scenario.

6. Claim Exemptions:

Maryland legislation gives a number of exceptions that guard certain styles of revenue from being dressed up. For instance, Social Security benefits, well-being settlements, and joblessness compensation are generally excluded from wage garnishment. Understanding these exemptions and adequately asserting them may assist decrease or get rid of wage garnishments.

7. Personal debt Consolidation or Settlement:

Take into consideration checking out financial obligation unification or settlement deal options to relieve your monetary concern and likely stop potential wage garnishments. Working along with a credible financial debt relief organization can easily assist you discuss lower rate of interest fees or decreased repayment quantities with your financial institutions.

8. Raise Income and Reduce Expenditures:

While it may not be an quick service to stop wage garnishment, raising your profit and decreasing expenses may aid strengthen your general economic situation in the lengthy run. Think about taking on extra part-time job or discovering techniques to cut down on non-essential expenses to relieve up even more loan for debt repayment.

Always remember that each situation is special, and what works for one individual might not operate for another when it comes to quiting wage garnishment in Maryland. It's important to consult with along with experts who focus in personal debt comfort strategies so they can analyze your certain conditions and lead you towards the very most efficient option.

By understanding Maryland's legislations pertaining to wage garnishment, looking for lawful assistance, arranging along with financial institutions, looking at bankruptcy as a final hotel alternative, contesting the opinion if applicable, declaring exceptions accessible under condition rule, exploring financial obligation unification or resolution choices if practical, and working in the direction of enhancing profit while lowering expenditures - people encountering wage garnishment in Maryland can easily take proactive steps towards quiting this procedure and restoring management over their funds.

In conclusion, facing wage garnishment is undeniably challenging, but there are approaches offered to help individuals in Maryland stop or reduce wage garnishments. It's essential to teach yourself on the regulations, find professional guidance, and discover numerous options to find the best answer for your details circumstance.